What is Factoring

Factoring is a short-term financial instrument offered to a company (a product/service provider) based on the sale of its receivables at a discounted price to a company called the Factor. Factoring is the purchase and financing of accounts receivable, coupled with the administration of accounts receivable, collection, and advisory services.

Factoring is mainly used by businesses to improve cash flow, but can also be used to reduce redundancy in administration. In order to qualify for a factoring transaction, the factoring recipient (Supplier) must operate in credit terms with its customers. The Supplier and the Debtor are subject to Factor Risk Analysis in order for the latter to approve a factoring limit.

Frequently asked questions

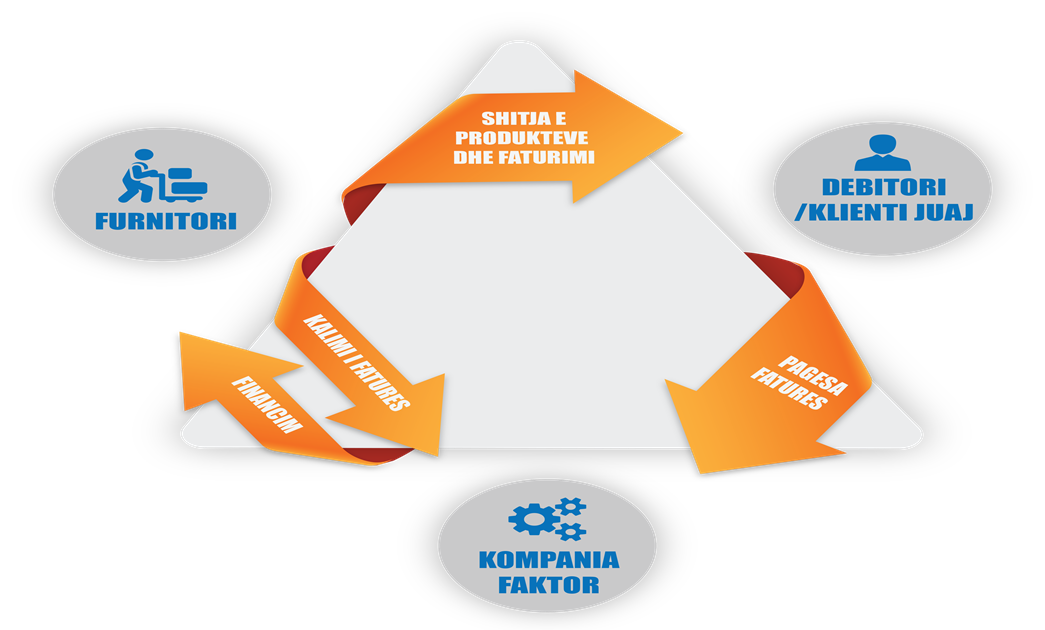

Factoring Concept

- Vendor issues the Customer invoices for products/services (invoices is received by the Customer without complaints or merchandise advertisements);

- The original copy of the tax invoice of this supply is passed to on the Factor;

- The factor finances the value of the tax invoice with VAT as per the agreed percentage minus the factoring fee;

- The factoring fee applies to the value of the invoice and the interest rate is calculated on the debit balance.

Type of Factoring Services

DOMESTIC FACTORING

Used between parties within the country.

IMPORT / EXPORT FACTORING

Used between parties outside the country.

INTERNATIONAL FACTORING

The factor is associated with a corresponding Factor in the foreign country.

PUBLIC SECTOR FACTORING

Used in cases where the debtor is a public entity.

INDIRECT FACTORING

Factoring of suppliers.

Factoring Products

- Supply Chain Factoring, whereby the Factor purchases the supplier’s receivables strategically significant to the Purchaser based on the Buyer-Factor Cooperation Agreement.

- Balancing Factoring, a product developed for clients working with the structure of assets and liabilities. It applies in cases where by assigning accounts receivable to a Factor, the volume of accounts receivable is reduced or their structure improves. Funds offered by the factoring company do not increase client exposure and do not increase the volume of external resources, but accelerated cash flow allows the reduction of general debt, provided they are used to repay the bank’s credit or debit.

- Small Business Factoring, largely focused on lower-paid customers with regular deliveries to selected smaller buyers. This difference is accompanied by a lower range of information and documentation required.

Recourse Factoring

- Discount rate – 20% on the nominal value over the invoice

- Administrative commission – 0.5% on the nominal value over each invoice

- Interes – min 0.9%-max 1% monthly (Interest is calculated on a daily basis and is deducted from the Price at the time of payment by the Factor to the Supplier)

- Currency – EUR, ALL, USD

Operational Procedure of Factoring

- Issuing of a tax invoice to Customer for supply with products/services;

- Invoice is received by the customer without complaints or reclamations on the goods or service;

- Original copy of the tax invoice of this supply is passed to the Factor, which marks the factoring stamp;

- Factor finances the value of the tax invoice with VAT per agreed with percentage minus the factoring fee;

- The factor collects the full value of the VAT invoice for the Customer after the maturity term is completed by reimbursing the difference held in advance as a guarantee.

Tariff Methods

There are several basic ways of charging the product, as detailed below:

REDUCED INVOICE METHOD

Applies a fixed rate on the invoice value referred to days until receipt of the invoice, e.g. the first 30 days of the debit invoice, a fixed rate and another rate for exceeding this deadline of 10 to 15 days. This rate is usually applied to small and frequent invoice volumes.

INTEREST RATE METHOD

Factor that uses this charging method points out the following:

- Factoring commission that is applied in percentages over the invoice value

- Administrative commission applied on the value of funding

- Interest rate for any amount of invoices that is calculated on the debit balance

Advantages of Factoring

- Beneficiary may stipulate the term between the date of supply of goods / services and the collection of payments by reducing the level of receivables and thus improve cash flow and liquidity;

- Funds passed to the Supplier through factoring can be used as needed, as it is not necessary to declare funds, which is a condition for some banking products;

- Using factoring, the Factor Beneficiary can improve the activity and optimize the terms from its suppliers in the case of pre-payments, due to the free flow of money as a result of factoring;

- Funding in factoring is mainly based on the quality of receivables rather than on the Supplier’s quality and financial balance;

- The amount of funding offered is fully adjusted to the volume of transactions executed with clients / debtors.

- One can always fund an invoice whenever funds are needed. Factoring helps get new clients and boost business.

- Qualification for factoring is relatively easy and can be done quickly. This makes factoring an ideal alternative for new and growing companies with a lack of cash flow.

- Factoring does not require collateral as a guarantee for funding.